In 2025, the maximum monthly Social Security benefit in the United States has been set at $5,108. However, this amount is only for a small group of people—those who retire at age 70 after earning high incomes and contributing to Social Security for at least 35 years.

According to the Social Security Administration (SSA), most people will not receive this much. In fact, 87% of Social Security recipients get less than $2,500 per month, and the average payment is $1,976.

Why Most People Get Less Than the Maximum Benefit

The amount you receive from Social Security depends on three main things:

1. Your retirement age – People who retire before age 67 get reduced benefits. Retiring at 62 could mean up to 30% less money.

2. How many years you’ve worked and contributed – To get the maximum, you need 35 full years of high earnings.

3. How much you earned – If your income was below the national average, your benefit will also be lower.

The SSA says that only 3% of retirees reach the full $5,108 monthly benefit. The system is made to reward people who delay retirement and contribute consistently over their careers.

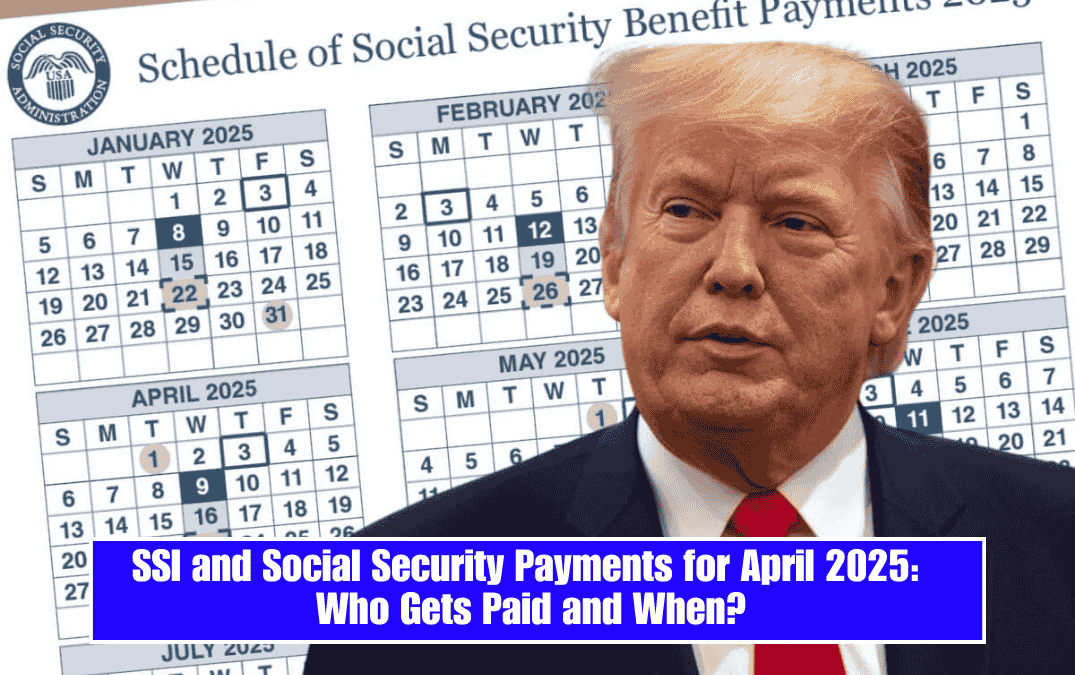

Payment Schedule: April and May 2025

Social Security payments follow a birthdate-based schedule. Here’s how it works:

For April 2025: People born 1st–10th got paid on April 9

People born 11th–20th got paid on April 16

People born 21st–31st will get paid on April 23

For May 2025:

- The same pattern will continue – second, third, and fourth Wednesdays of the month.

- The SSA recommends checking its official website calendar to make sure you know your correct payment date.

COLA 2025: Cost-of-Living Adjustment and Its Impact

Starting January 2025, a 2.5% COLA (Cost of Living Adjustment) was applied to Social Security benefits to help keep up with inflation. This increase affects around 68 million Americans.

But the COLA is proportional, not the same for everyone. For example:

Someone receiving $1,500/month will get an extra $37.50

Someone receiving $2,000/month will get $50 extra

So, even with the COLA, you will not receive the maximum benefit unless your earnings and history already qualified you for it.

Big Change: WEP and GPO Repealed

A new law called the Social Security Fairness Act was passed in January 2025. This law removed two old rules:

WEP (Windfall Elimination Provision)

GPO (Government Pension Offset)

These rules previously reduced Social Security benefits for teachers, firefighters, and public workers with pensions not covered by Social Security.

Now, because of this repeal:

About 3.2 million people will receive higher monthly payments

These changes are retroactive from January 2024

Some retirees are getting back payments of $6,000 or more

How Much Could Your Benefit Increase?

According to the International Association of Firefighters (IAFF):

Some beneficiaries have seen monthly increases of $587 to over $1,000

These changes are based on each person’s unique tax and work history

Around 2.1 million retirees and 770,000 spouses or survivors are eligible for these increases

But remember: not everyone will get the same amount. It all depends on your individual case, such as your job history, pension type, and how long you contributed to Social Security.

While the maximum Social Security benefit in 2025 is an impressive $5,108, very few people qualify for it. Most retirees will receive far less, with an average of around $1,976 per month. Your benefit depends on how long you worked, how much you earned, and when you retired.

Thanks to recent reforms like the repeal of WEP and GPO, many public sector retirees are seeing a significant boost in their monthly payments. But these increases are separate from the COLA and require individual evaluation.

To know what you’re eligible for, it’s best to check your SSA account, use the online benefit calculators, or visit your local Social Security office. Every case is unique, and understanding your benefit can help you plan better for your future.