Contrary to popular belief, several stimulus checks remain in place in the United States in 2025, allowing for additional funding to be provided to those in greatest need. Even though the 2024 plans are now out of date, it is not that simple, and some initiatives will never be used by those who are unsure what to do.

Governor Kathy Hochul’s new effort is expected to benefit more than 2.75 million children, the largest increase in New York’s child tax credit in history. It also stated that the credit’s current value would be significantly increased.

Americans are unaware of these stimulus checks in the United States

The aforementioned stimulus checks in New York will provide 1.6 million families with an annual tax credit of up to $1,000 per child under the age of four, and up to $500 per child aged four to sixteen.

Households with children under the age of four will be eligible for a $1,000 tax credit in 2025, while those with children over the age of four will receive a $500 tax credit in 2026. The proposal will be implemented over the next two years.

Colorado Tax Refunds

Colorado is providing a stimulus check to low-income residents who are struggling to pay high rent, heating costs, and property taxes through a rebate program. Depending on their specific situation, applicants who submit their applications by April 15, 2024 will receive anywhere from $800 to $1,600.

Even if you missed the deadline, you still have until December 31, 2025 to submit your application. Individuals earning less than $18,016 in 2023 may be eligible for a refundable credit of up to $1,112 per year, while joint filers must earn less than $24,345.

Stimulus checks in California

The Sacramento Family First Economic Support Pilot (FFESP), a basic income pilot program, has been launched in Sacramento, California. Selected families will receive $725 per month through this program.

While researching the impact of guaranteed income on the community, the initiative aims to provide financial stability to vulnerable households.

The program is currently unique in that no other programs similar to FFESP are known to exist in other states or cities in the United States, and the pilot’s success will determine its future.

Stimulus checks from the Permanent Dividend Fund (PFD)

The Permanent Fund Dividend (PFD) stimulus check has already been issued, according to confirmation from Alaska’s well-known oil and gas revenue distribution program. This year, each qualified person will receive $1,702, up from $1,312 in 2024.

This increase is due to the state’s economic prosperity and commitment to sharing resources with its citizens. The Alaska Department of Revenue estimates that checks for energy assistance and Permanent Fund dividends will total $1,702.

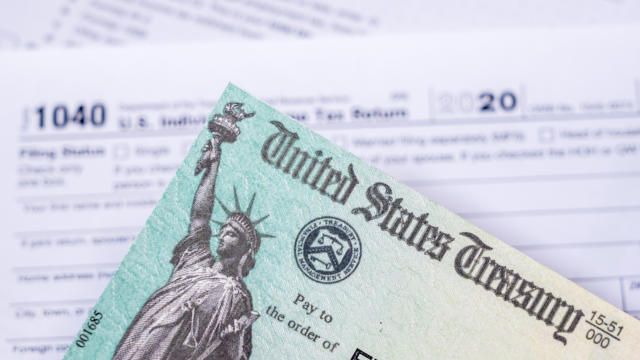

The Internal Revenue Service (IRS) will deliver new checks before the end of this month

Depending on how they filed their 2021 tax returns, Americans could receive a stimulus check worth up to $1,400 by the end of the month. U.S. taxpayers who did not claim the Recovery Rebate Credit on their 2021 tax returns will receive stimulus checks totaling approximately $2.4 billion, up to $1,400 per individual, according to an announcement made by the Internal Revenue Service in December.

Because many eligible taxpayers who filed a 2021 tax return failed to claim the Recovery Rebate Credit, a refundable credit for individuals who did not receive one or more economic impact payments (EIPs), also known as stimulus payments, the Internal Revenue Service said it issued this round of stimulus checks after reviewing internal data.

Who can receive the upcoming stimulus checks from the IRS?

The most recent stimulus check is now available to those who did not claim the Recovery Rebate Credit on their 2021 tax returns. Taxpayers can determine whether they claimed this credit by reviewing their 2021 tax return and noting whether they filled in the Recovery Rebate Credit field with a value of 0 or left it blank.