In the United States, Tax Refund 2025 payments have already begun to appear in the bank accounts of those who filed their returns early in the tax season. However, some taxpayers who have submitted all required documentation are still waiting for their refunds.

Regardless of the delay, there is no cause for concern. If you are eligible for a refund, the IRS will process it in the coming weeks. The exact date depends on when you filed your tax return.

Estimated Dates for Receiving the 2025 Tax Refund

The IRS reviews each tax return individually, so timelines may vary depending on the case. However, based on previous years, here are the approximate dates you could receive your refund via direct deposit:

- Filed on January 27: deposit around February 17

- Filed on January 28: deposit around February 18

- Filed on January 29: deposit around February 19

- Filed on January 30: deposit around February 20

- Filed on January 31: deposit around February 21

- Filed on February 1: deposit around February 22

- Filed on February 2: deposit around February 23

- Filed on February 3: deposit around February 24

- Filed on February 4: deposit around February 25

- Filed on February 5: deposit around February 26

- Filed on February 6: deposit around February 27

- Filed on February 7: deposit around February 28

- Filed on February 8: deposit around March 1

- Filed on February 9: deposit around March 2

- Filed on February 10: deposit around March 3

- Filed on February 11: deposit around March 4

- Filed on February 12: deposit around March 5

- Filed on February 13: deposit around March 6

- Filed on February 14: deposit around March 7

- Filed on February 15: deposit around March 8

- Filed on February 16: deposit around March 9

- Filed on February 17: deposit around March 10

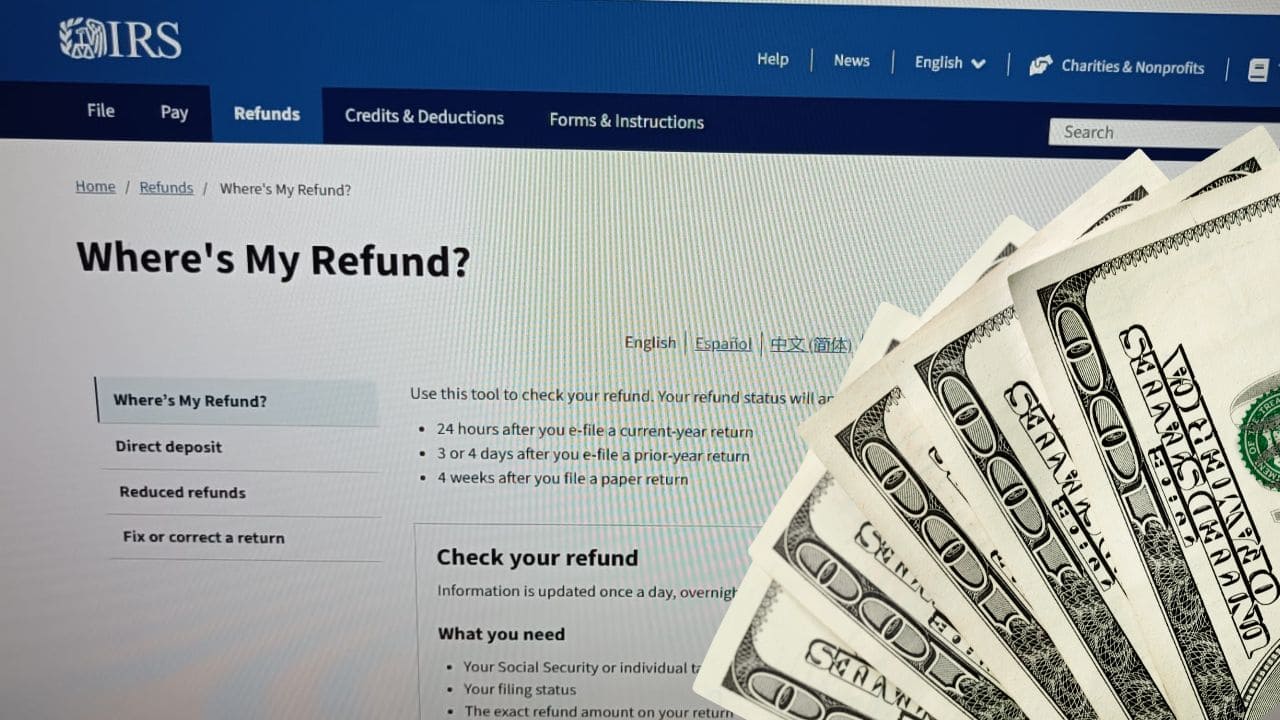

How to Check Your Refund Status

If you have already filed your tax return, make sure to check your bank account on a regular basis. Additionally, the IRS offers the official Where’s My Refund tool, which allows you to track your refund status in real time.

Patience is the key right now. If your tax return was properly submitted and error-free, the IRS will process your refund within the expected timeframes.